The Basic Principles Of Transaction Advisory Services

Wiki Article

Getting The Transaction Advisory Services To Work

Table of ContentsThe Best Guide To Transaction Advisory ServicesNot known Factual Statements About Transaction Advisory Services Getting The Transaction Advisory Services To WorkHow Transaction Advisory Services can Save You Time, Stress, and Money.The Only Guide for Transaction Advisory Services

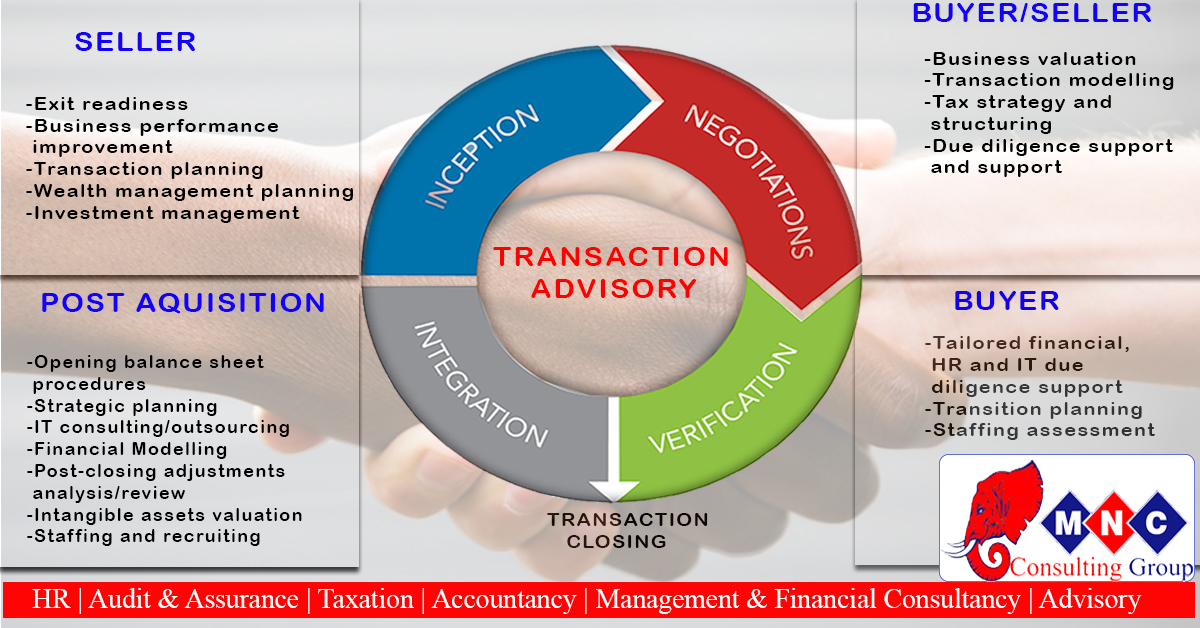

This step makes sure the business looks its ideal to prospective customers. Obtaining the organization's value right is essential for a successful sale.Transaction experts action in to aid by obtaining all the required information arranged, responding to questions from purchasers, and preparing brows through to the business's place. Transaction advisors utilize their knowledge to help organization owners deal with tough settlements, satisfy purchaser expectations, and structure bargains that match the proprietor's goals.

Satisfying lawful guidelines is essential in any kind of business sale. They assist service owners in planning for their next actions, whether it's retired life, beginning a brand-new endeavor, or managing their newfound wide range.

Transaction experts bring a wealth of experience and understanding, guaranteeing that every element of the sale is handled professionally. With critical prep work, assessment, and settlement, TAS aids local business owner attain the greatest possible price. By making sure lawful and regulatory compliance and managing due persistance along with other offer staff member, purchase advisors reduce prospective dangers and responsibilities.

See This Report about Transaction Advisory Services

By comparison, Huge 4 TS groups: Job on (e.g., when a potential buyer is conducting due diligence, or when an offer is closing and the buyer needs to incorporate the business and re-value the seller's Balance Sheet). Are with fees that are not linked to the bargain shutting efficiently. Make charges per engagement somewhere in the, which is less than what investment banks gain also on "little offers" (however the collection likelihood is also much greater).

The interview inquiries are extremely similar to investment financial meeting questions, however they'll focus a lot more on accounting and evaluation and much less on topics like LBO modeling. Anticipate concerns regarding what the Adjustment in Working Capital means, EBIT vs. EBITDA vs. Take-home pay, and "accountant only" topics like test balances and how to walk via events using debits and credit reports rather than economic declaration modifications.

A Biased View of Transaction Advisory Services

Experts in the TS/ FDD teams may likewise speak with monitoring about whatever above, and they'll write a thorough report with their searchings for at the end of the procedure.The power structure in Deal Services varies a little bit from the ones in investment banking and exclusive equity jobs, and the basic shape appears like this: The entry-level function, where you do a whole lot of information and financial evaluation (2 continue reading this years for a promo from below). The following degree up; similar work, however you obtain the even more intriguing little bits (3 years for a promo).

Specifically, it's difficult to obtain advertised beyond the Supervisor degree because few individuals leave the task at that stage, and you require to start revealing proof of your capability to create profits to development. Let's begin with the hours and way of life considering that those are easier to define:. There are periodic late evenings and weekend break work, but nothing like the frenzied nature of financial investment banking.

There are cost-of-living changes, so expect reduced compensation if you're in a more affordable location outside major monetary (Transaction Advisory Services). For all positions except Companion, the base salary makes up the mass of the overall settlement; the year-end bonus may be a max of 30% of your base wage. Often, the most effective means to increase your profits is to change to a various firm and work out for a greater wage and benefit

Transaction Advisory Services for Beginners

At this phase, you should just stay and make a run for a Partner-level function. If you want to leave, possibly relocate to a client and execute their evaluations and due persistance in-house.The primary problem is that due to the fact that: You generally require to sign up with one more Big 4 team, such as audit, and work there for a few years and then relocate right into TS, work there for a couple of years and afterwards relocate right into IB. And there's still no warranty of winning this IB function due to the fact that it relies on your area, customers, and the working with market at the time.

Longer-term, there is likewise some threat of and since evaluating a firm's historic financial details is not exactly rocket scientific research. Yes, humans will constantly need to be entailed, but with advanced innovation, reduced headcounts can potentially sustain client engagements. That said, the Deal Solutions group defeats audit in terms of pay, job, and departure opportunities.

If you liked this post, you may be interested in analysis.

The smart Trick of Transaction Advisory Services That Nobody is Talking About

Develop sophisticated financial structures that aid in determining the real market price of a company. Offer consultatory work in relationship to business appraisal to help in negotiating and rates structures. Explain the most ideal type of the offer and the kind of factor to consider to utilize (money, stock, gain out, and others).

Establish action prepare for danger and exposure that have actually been recognized. Do combination planning to identify the procedure, system, and business changes that might be needed after the deal. Make mathematical estimates of assimilation expenses and benefits to evaluate the financial my site rationale of assimilation. Set standards for incorporating departments, innovations, and company procedures.

Assess the prospective consumer base, sector verticals, and sales cycle. The functional due diligence supplies important insights right into the performance of the firm to be obtained worrying threat assessment and worth creation.

Report this wiki page